Tax Appeal Appraisals

Helping You Find Fairness in Property Taxes with Objective Appraisals

Tax Appeal Appraisals

's Leading Appraisal Firm

Providing high quality appraisals of residential and commercial properties in a timely & professional manner.

's Leading Appraisal Firm

Providing high quality appraisals of residential and commercial properties in a timely & professional manner.

's Leading Appraisal Firm

Providing high quality appraisals of residential and commercial properties in a timely & professional manner.

Ensure You’re Paying Fair Property Taxes

Significant increases in property assessments can raise understandable concerns about whether a property is being taxed fairly. At Appraisal Resources, Ltd., we assist property owners by providing independent, well-supported appraisals to determine whether an assessed value reasonably reflects market value.

Our role is to bring clarity to the tax appeal process through objective analysis and credible valuation—not advocacy. We use a structured, two-phase approach designed to protect clients from unnecessary expense while providing reliable support when a tax appeal is warranted.

We Specialize In Appraisals For:

SAVE MONEY

Choosing an appraiser you can trust can save you thousands of dollars and help you make better informed decisions.

AVOID CONFUSION

We walk you through the appraisal and make sure all of your questions are answered.

STRESS-FREE PROCESS

We will make your experience stress-free by being efficient, transparent, and simplifying the entire process for you.

Our Simple 3 Step Appraisal Process

Step 1: Connect With Us

Reach out via our website, phone, or email. We'll discuss your needs and unique situation.

Step 2: Expert Evaluation

We conduct a thorough appraisal tailored to your property, ensuring accurate and reliable results.

Step 3: Informed Decisions

With our detailed appraisal, you can make well-informed decisions with complete confidence.

What Is a Tax Appeal Appraisal?

A tax appeal appraisal is an independent, professional opinion of market value prepared to evaluate whether a property’s assessed value for tax purposes is fair and well supported. These appraisals are commonly used to:

Challenge over assessed property values and ensure taxes reflect true market conditions

Provide credible evidence for formal tax appeals, including hearings before boards of revision or similar authorities

Support attorneys and accountants with reliable, market-based valuation conclusions

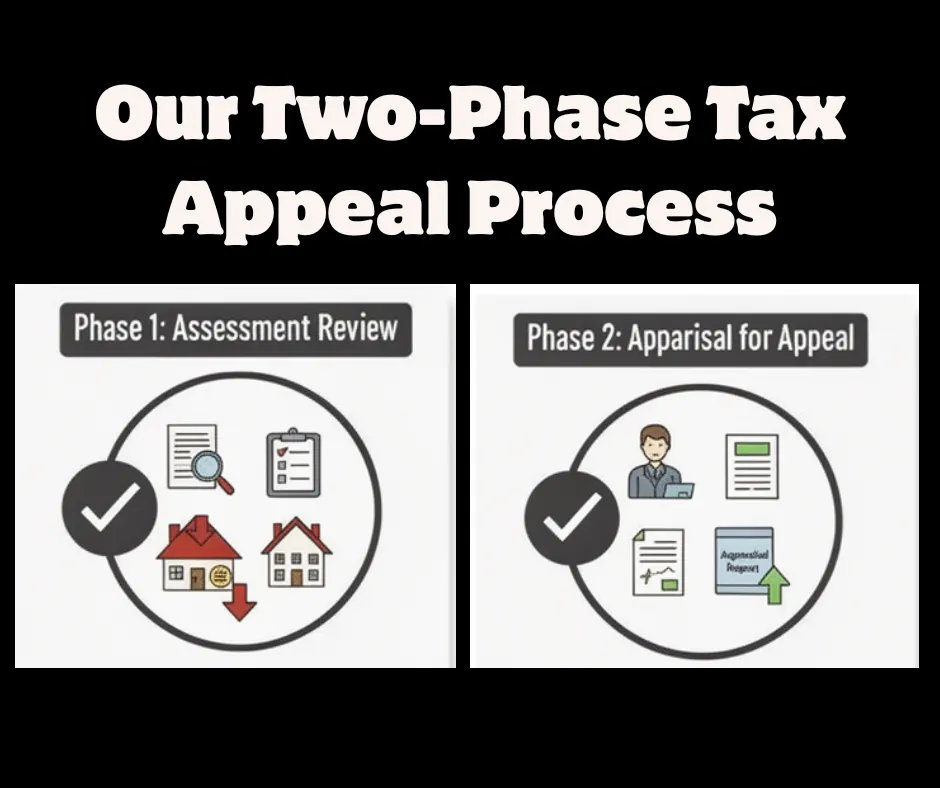

A Tax Appeal Appraisal Involves Two Key Phases

In the First Phase, we approach each property with care, conducting a thorough evaluation to determine if the assessed value is reasonable. We know that appealing taxes can be daunting, so this step is designed to protect you from unnecessary expenses or efforts if your property is already fairly assessed. However, if our analysis shows that your property’s true value is below the Auditor’s assessment, we move to the second phase with confidence.

In the Second Phase, our experienced appraisers provide a detailed, evidence-based appraisal report that serves as strong support for your tax appeal. Our goal is to be a supportive guide in this process, helping you navigate it with ease and working hard to secure an objective and fair outcome for you and your family. Our two-phases approach is outlined as follows:

Phase 1: Assessment Review

We begin with a preliminary review of the property and the auditor’s valuation to determine whether the assessment appears reasonable based on current market evidence.

This review includes:

Analysis of property characteristics

Review of recent market activity

Comparison of market indicators to the assessed value

If the assessment is supported or favorable, no further action is recommended—helping clients avoid unnecessary expense.

Phase 2: Appraisal for Appeal

If the initial review indicates that the property’s market value is lower than the assessed value, we proceed—at your direction—with a comprehensive appraisal.

The appraisal report includes:

Market analysis

Comparable sales research

An accurate, impartial, and well-supported opinion of value

The completed report is suitable for use as evidence in the tax appeal process and is developed in compliance with professional appraisal standards.

Appraisal Services Offered

✔ Residential Tax Appeal Appraisals

– Single-family homes, condominiums, and small to mid-size multi-family properties

✔ Commercial & Investment Properties Appraisals

– Apartments, retail, office, and mixed-use properties

✔ Market Value Studies

– Independent opinions of value supported by current, relevant market data

✔ Expert Witness & Hearing Support

– Defensible appraisal reports suitable for boards of revision, appeals boards, and court proceedings

Why Clients Trust Us

Accurate & Defensible

Appraisals developed in compliance with professional standards and supported by strong market evidence.

Meaningful Cost Impact

A successful appeal can result in significant, ongoing reductions in property tax obligations.

Purpose-Built Reporting

Reports tailored for tax boards, attorneys, and accountants.

Local Market Knowledge

Experience with property values across Northwest Ohio, grounded in local data and assessment practices.

Qualified Hearing Experience

Prepared to provide expert testimony when required.

Who We Serve

Homeowners

Helping ensure residential properties are fairly assessed

Attorneys

Providing credible valuation support for tax appeal cases

Accountants & CPAs

Supplying reliable market value conclusions for tax and financial analysis

Property Owners & Investors

Clarifying market value relative to assessed value when evaluating appeal options

Get a Free Quote for Your Tax Appeal Appraisal

Expertise in Tax Appeals: We are experienced in the intricacies of the tax appeal process and know how to prepare appraisals that meet the specific requirements of taxing authorities.

Unbiased Reports: As independent appraisers, we follow strict ethical guidelines to ensure that our appraisals are objective and based on comprehensive market analysis.

Client-Centered Service: We understand that appealing a property tax assessment can be stressful, and we’re here to guide you through every step of the process.

Local Knowledge: Deep understanding of the local area real estate market

Don’t overpay on property taxes another year. Get a credible, defensible tax appeal appraisal today.

📞 Call us now at 419-356-6419

📧 Email: [email protected]

💻 Or fill out our free quote request form to request a consultation.

Lower your taxes. Protect your bottom line. Start with the right appraisal.

Meet Jon

Click here to learn more about Jon J. Meyers, SRA.

Why We're Different

We prioritize professionalism and integrity to ensure you have the best experience with our appraisers.

Reviews

Learn why we are one of the top rated appraisal firms in the area.